Selling Your Luxury Watch

A designer watch is as much a statement piece as much as it is a wearable item of jewellery. A status symbol worn on the wrist that brings confidence, elegance, style & presence. You may have decided that it’s time to sell your own (pun intended), perhaps to upgrade to a better model or for the purpose of raising capital for something else important at this time. We’ll briefly be covering some of the areas you’ll need to consider when selling your luxury watch.

How much do I get?

The price you’ll be paid for your luxury watch depends on a host of factors but for this purpose we're going to focus the two most important:

The amount of time you're prepared to wait to sell

The current value on today's market

Note that the first factor you control - the second you don’t. Now you might have expected the two most important factors to be ‘condition’ & ‘model’ but those factors don’t affect value as much as the two we’ve listed. You may be in ownership of a top spec model from a popular watch brand but if you’re expecting to cash in more than the going market rate for the watch - you’ll likely be holding onto it for a while - therefore defeating the whole purpose of seeking a sale.

How long are you prepared to wait for a sale:

Now, designer watches don’t tend to sell overnight, but if you’re in a rush to sell they quite possibly could, but then you may not be in desperation to have your luxury watch sold.

It’s all about finding that sweet-spot between the price which will attract buyers but not pricing yourself so low where you feel you’ve been robbed.

there are always ways to accelerate that sale so it doesn’t take weeks & months. Lowering your expectations around sale price is one way you can make this happen - depending of course on how much you’re willing to sell for. If you're not in a rush to sell - then you may have the luxury of raising your expectations on the sale price.

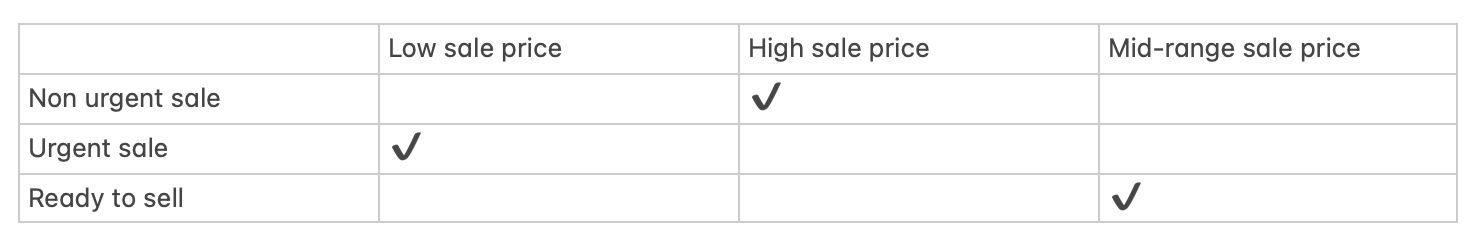

The representation below demonstrates this :

With a sale being more or less urgent, prices change to reflect an owner's desire to sell.

There are other factors affecting the value you might receive for a luxury watch. Let's take a Rolex Daytona watch as an example:

The spec you have

Above you have listed the specifications of the watch - each of the factors determining watch value. The more that is known about your watch the better placed it is to receive a price valuation. Age for example contributes largely to watch value, with condition also being a major factor. Subtle variations such as having the bracelet in white gold as opposed to yellow gold might make your watch more or less desirable on the market. Get a valuation of your watch today

The current value on today's market:

Prices for luxury watches are sensitive to factors determined by levels of demand & supply. As buyers search the second hand market for their next luxury watch purchase - certain pointers will guide their buying decisions:

“Am I getting this watch at a good price?”

“Will this watch be worth more in a couple years?”

Market Supply

Luxury watch makers are experts when it comes to setting their watch prices and ensuring those prices never, never come down. This is why they release only a limited number of that new watch model into the market. This ensures that you have a lot going after a little - the effect on the price of the watch - up-up & away.

Other factors used to value your luxury watch :

Sale history: How many watches are currently being sold on the used market? Keep an eye on this - it’s a real indicator of the desirability and demand for your watch.

How many watches from the model which you have sold over the course of the last 6 months, 1 years or even 3 years. This valuable piece of information will tell you what like-for-like luxury watches fetched in in the last 6 months, 2 or 5 years. Find this information out and use it to your advantage. A steady volume of sales over the past 12 months indicates that your watch is in demand and how soon you might be able to procure a sale for yours.

Demand - The current level of market interest for this type of goods: Demand works hand in hand with supply. How many people want what you have & how urgently?

Supply - How many similar goods are on the market today? If there's a limited supply of certain goods, the price will be driven upwards meaning you can expect a larger than usual return on your goods. If you know anything about the goods resale industry you might have heard how shoes & trainers are resold for up to 10 times their retail price.